Tax professional Keith Hall has released a new book detailing a tax strategy that enables small business owners to hire their children and potentially save thousands of dollars annually. 'Hire Your Kid' provides a step-by-step guide to creating legitimate employment for children within a family business, making wages tax-deductible while teaching valuable life lessons.

The strategy outlined in the book allows parents to pay their children reasonable wages for work performed in the business, then use the tax savings to fund their children's financial futures through vehicles like Roth IRAs. Hall draws from 40 years of experience as a CPA working with small business owners to simplify what he describes as a practical approach to reducing tax liability.

This approach matters because it addresses two significant challenges facing small business owners: reducing tax burdens and preparing the next generation for financial success. With small businesses often operating on tight margins, a strategy that can save over $5,000 annually represents meaningful financial relief that could be reinvested in business growth or family needs.

The book's importance extends beyond immediate tax savings by creating opportunities for financial education and family bonding through shared work. Hall emphasizes that the strategy turns everyday family expenses into legitimate business deductions while providing children with early exposure to work ethics and financial responsibility.

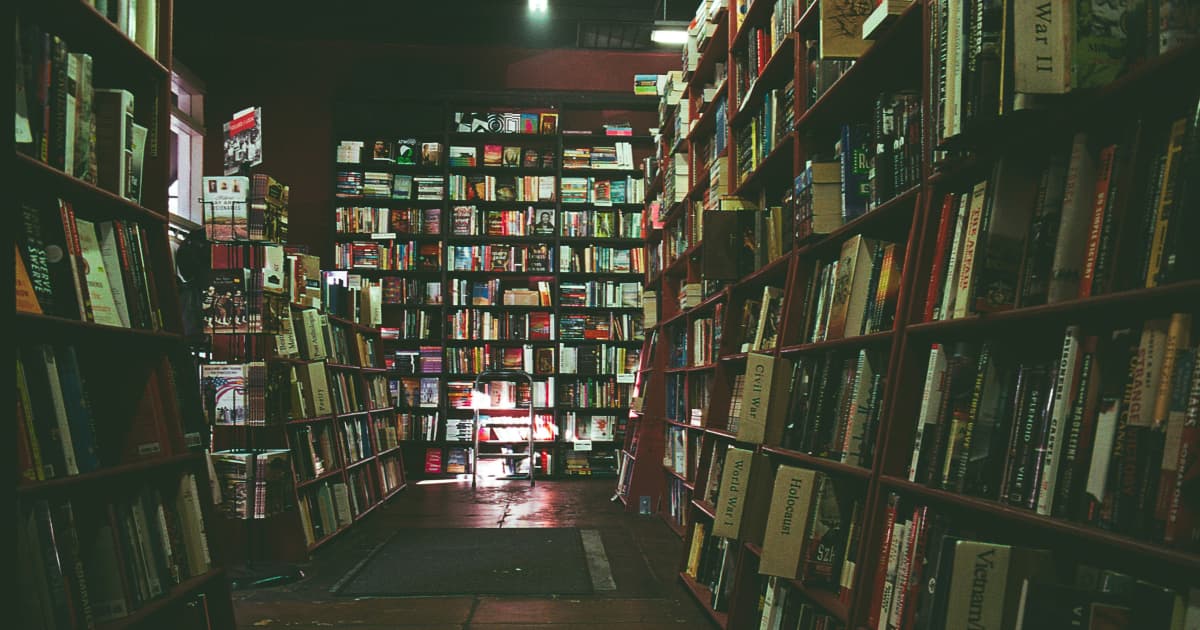

For the publishing industry, books like 'Hire Your Kid' represent a growing niche of practical financial guides targeting specific professional demographics. The small business sector represents a substantial market for publishers, with owners constantly seeking actionable strategies to improve their financial positions.

The broader implication involves changing how families approach business and financial planning, potentially influencing how multiple generations participate in family enterprises. As tax laws continue to evolve, strategies that legally optimize deductions while providing family benefits will likely remain relevant for business owners navigating complex financial landscapes.

'Hire Your Kid' will be available in both print and digital formats, making the strategy accessible to business owners across different reading preferences. The book's practical approach reflects Hall's experience working with thousands of entrepreneurs to implement tax strategies that deliver measurable financial benefits.